Your current location is:Fxscam News > Platform Inquiries

Binance exits Russian market, stops Ruble transactions from Nov 15, 2023

Fxscam News2025-07-23 09:04:55【Platform Inquiries】3People have watched

IntroductionCompanies that implement foreign currency transactions,Invest 200,000 in Forex and Earn 10,000 per Month,1. Binance Prepares to Completely Exit the Russian Market, Will Stop Accepting Ruble Deposits and Wi

1. Binance Prepares to Completely Exit the Russian Market,Companies that implement foreign currency transactions Will Stop Accepting Ruble Deposits and Withdrawals Starting November 15, 2023

Cryptocurrency exchange titan Binance officially announced on November 10 that it will stop accepting deposits and withdrawals in Russian rubles starting November 15, 2023, and expects to terminate ruble withdrawals by January 31, 2024. Binance advises users to withdraw their ruble deposits as soon as possible, while customers can transfer funds to CommEX. This exchange has acquired all of Binance's operations in Russia.

2. ASIC: Retail Over-The-Counter Derivatives Investors Receive Over 17.4 Million Australian Dollars in Compensation

According to the Australian Securities and Investments Commission (ASIC), since March 2021, eight issuers of over-the-counter derivatives who violated financial services laws have compensated or promised to compensate over 2,000 retail customers more than 17.4 million Australian dollars.

3. dxFeed Appoints Bruce Traan as Global Head of Indices

Capital market data service provider dxFeed announces the appointment of Bruce Traan as the new Global Head of Indices. With over twenty years of experience in the financial sector and outstanding performance in index management, his joining is set to help dxFeed fulfill its commitment to provide innovative and comprehensive index solutions to the global financial markets.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(2667)

Related articles

- The Chinese electric vehicle industry calls for strengthening global cooperation.

- Dollar weakness boosts gold rebound as markets focus on data and policy before Thanksgiving.

- Gold nears the $2800 threshold; technicals suggest a short

- Russia's hypersonic missile launch sparks risk

- AMICUS FINANCE Scam Exposed: How David Analyst Manipulates Investors

- The dollar may underestimate trade tension risks, with exchange rate uncertainty ahead.

- Israel rejects calls for a ceasefire; gold prices hit a new high.

- The World Bank is optimistic about silver, expecting prices to rise in the next two years.

- Is Maxifyfx Ltd a Reliable Trading Platform?

- Geopolitical tensions and a weaker dollar drove gold prices above $2,660.

Popular Articles

Webmaster recommended

Saudi Arabia readies $40 billion venture fund for AI investment. Will it spark new growth?

Goldman Sachs predicts a pound surge and long

The Canadian dollar is seen as a hedge against Trump's victory, with its safe

Gold prices rise as market eyes economic data and Fed policy.

VeracityFX Review: High Risk (Suspected Fraud)

BOJ hints at a rate hike, boosting the yen as markets eye December action.

USD strengthens against CAD as markets expect BoC’s dovish stance to boost its rise.

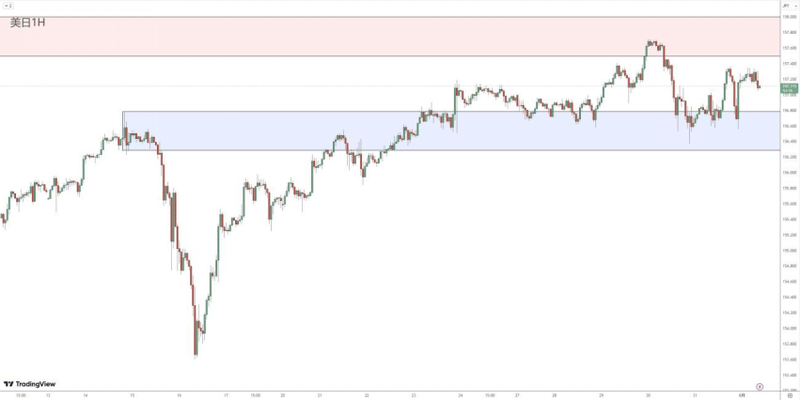

The yen is capped by BOJ policies, with USD/JPY near key levels.